Hui Zhang

In 2023, the China National Nuclear Corporation (CNNC) completed and may have started operating two large new centrifuge enrichment plants (CEP).

CNNC is operating three large centrifuge enrichment facilities that produce LEU for civilian purposes: Lanzhou (Gansu province, Plant 504), Hanzhong (Shaanxi province, Plant 405), and Emeishan (Sichuan province, the Emeishan civilian facility of Plant 814) (for more detail see: Hui Zhang, "China's uranium enrichment and plutonium recycling 2020-2040: current practices and projected capacities," in China's Civil Nuclear Sector: Plowshares to Swords?). In 2023, CNNC added two new centrifuge enrichment plants (CEP) to these facilities: Emeishan CEP3 (i.e. Project 3 at Emeishan) and Lanzhou CEP5.

Emeishan CEP3

Satellite imagery taken in February 2015 shows early construction activities at Emeishan CEP3, including preparation for pad construction. The images also reveal that construction was suspended from at least February 2016. However, according to local government documents, construction resumed and continued from 2019 through 2022. Satellite images show that major construction work was completed around November 2021. According to Chinese sources, Emeishan CEP3 started trial production as early as January 2023, and was expected to begin normal operation around the end of 2023. Unlike the other two facilities at Emeishan, CEP1 and CEP2, which are equipped with first-generation centrifuges, CEP3 is believed to be using second-generation centrifuges. These have been operating at the Hanzhong plant 405 since 2017.

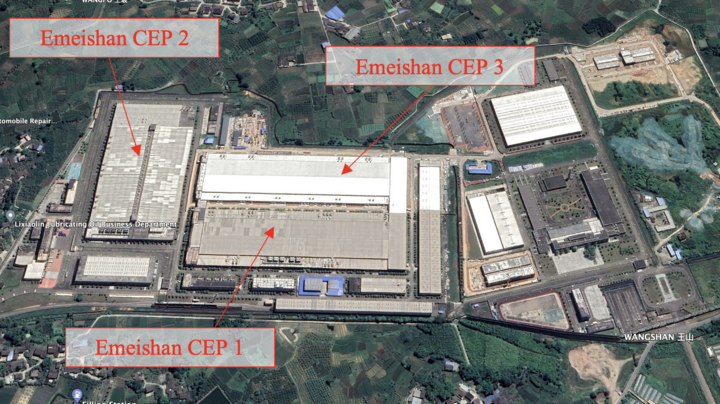

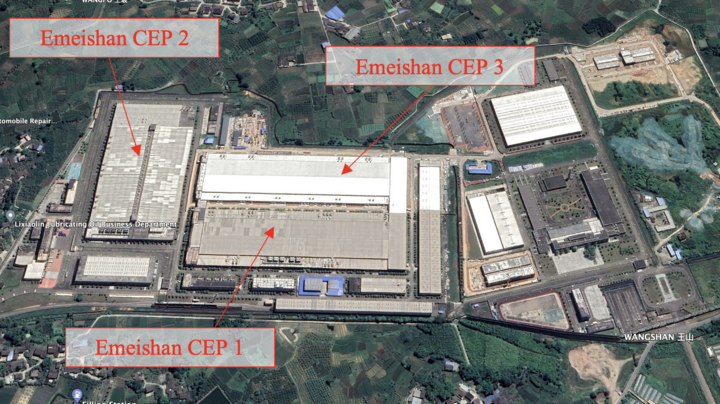

Emeishan CEP3 is believed to have a capacity of about 1.5-2 million SWU/year. Therefore, when combined with Emeishan CEP1 and Emeishan CEP2, which have a combined capacity of 2.2 million SWU/year, the total estimated capacity of the Emeishan enrichment facility has risen to approximately 4 million SWU/year. The image above, taken in May 2022, shows the layout of the facility (29.677314, 103.534625, Credit: CNES/Airbus, Google Earth).

Emeishan CEP3 is believed to have a capacity of about 1.5-2 million SWU/year. Therefore, when combined with Emeishan CEP1 and Emeishan CEP2, which have a combined capacity of 2.2 million SWU/year, the total estimated capacity of the Emeishan enrichment facility has risen to approximately 4 million SWU/year. The image above, taken in May 2022, shows the layout of the facility (29.677314, 103.534625, Credit: CNES/Airbus, Google Earth).

Lanzhou CEP5

Construction activity at the main building of the Project 5 plant is visible in satellite images taken in late 2014. Other images also indicate that construction appeared to have been suspended in late 2015, but it resumed in the second half of 2022. The construction was apparently completed in early 2023, and according to Chinese sources, the Project 5 plant began initial operations around fall 2023. It is expected to start normal operations as early as the end of 2023.

As with Emeishan CEP3, Lanzhou CEP5 uses second-generation centrifuges and is estimated to have the total estimated capacity of 1.5-2 million SWU/year. Since the capacity of the other four plants at Lanzhou is about 2.6 million SWU/year, operations of Project 5 plant will bring the total capacity of Lanzhou plant to about 4.4 million SWU/year. The image above, taken in November 2022, shows the layout of the Lanzhou facility (36.148139, 103.523472, Credit: Maxar, Google Earth).

As with Emeishan CEP3, Lanzhou CEP5 uses second-generation centrifuges and is estimated to have the total estimated capacity of 1.5-2 million SWU/year. Since the capacity of the other four plants at Lanzhou is about 2.6 million SWU/year, operations of Project 5 plant will bring the total capacity of Lanzhou plant to about 4.4 million SWU/year. The image above, taken in November 2022, shows the layout of the Lanzhou facility (36.148139, 103.523472, Credit: Maxar, Google Earth).

The table below describes individual plants at Emeishan and Lanzhou.

China's enrichment capacity

Taking into account the Hanzhong plant 405, which has a capacity of about 2.7 million SWU/year, China's total enrichment capacity is about 11 million SWU/year. This would be sufficient to provide enrichment services for the reactors with the total installed capacity of 70 GWe, which, according to the 14th Five-Year Plan (2021-2025), China is set up to achieve by 2025. Most of these reactors are light-water reactors, which are assumed to require about 130 tonne-SWU/year/GWe.

If China plans to bring its installed nuclear capacity to about 100 GWe by 2030, this will require an enrichment capacity of about 13 million SWU/year. It is anticipated that China will install about 2 million SWU/year or more during next Five-Year Plan (2026-2030). This expansion means that China will significantly increase its enrichment capacity. However, currently, it will primarily focus on servicing domestic demand.