The President of Russia signed a federal law that formally ended Russia's participation in the US-Russian Plutonium Management and Disposition Agreement (PMDA). The law denounces the agreement, signed on 29 August 2000 in Moscow and on 1 September 2000 in Washington, and the protocols to the agreement, signed on 15 September 2006 and on 13 April 2010.

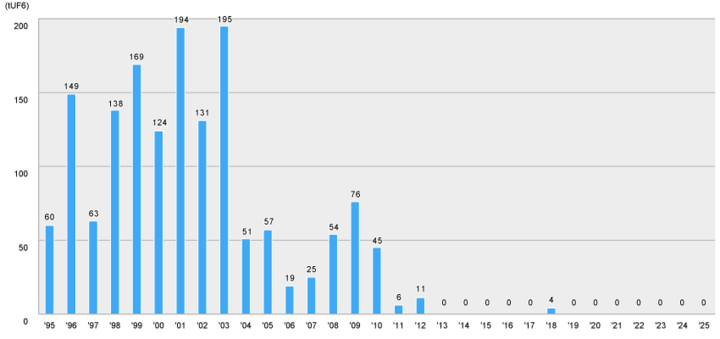

The agreement, as amended by a protocol in 2010, committed the United States and Russia each to eliminate 34 tonnes of plutonium "designated as no longer required for defense purposes."

Russia suspended the implementation of the agreement in October 2016, citing "unfriendly actions of the United States." To a large extent the suspension was a result of a dispute about the United States unilaterally changing its plutonium disposition method (see also earlier IPFM analysis as well as this article).

It is worth noting that while Russia ratified PMDA in 2011, the agreement has never been in force. The Federal Law No. 108-FZ on the ratification of PMDA was signed by the then-President Medvedev on 3 June 2011. The law would have entered into force ten days after its official publication on the pravo.gov.ru portal. However, it has never been officially published and therefore the agreement has never entered into force. For this reason, the current law denounces the agreement and its protocols directly rather than denouncing the 2011 law that ratified it.

In 2016, Russia's participation in the PMDA was suspended by a presidential decree (which also did not mention the fact of ratification in 2011). In it, President Putin decreed:

To establish that plutonium covered by the [PMDA] Agreement [...] shall not be used for the purposes of manufacturing nuclear weapons or other nuclear explosive devices, for research, development, design, or testing related to such devices, or for any other military purposes.

The legal status of this obligation is not clear but it appears to remain in force unless a subsequent presidential decree revokes it. The Federal Law No. 381-FZ from 31 October 2016, which was passed to codify the suspension, does not contain this clause. The law on the denunciation of PMDA does not revoke or even mention the 2016 decree, so it appears that the obligation not to use the PMDA material for military purposes continues to apply.